What Is Short Selling and What Is A Short Squeeze?

Understanding The GameStop Shorting and Short Squeeze In Layman Example In Under 5 Minutes

Typically when we invest in stocks, we would buy now and hold on to them until the underlying becomes more valuable and sell it. This is going “long”. The idea is that we want the stock price to go up, in other words, we make a profit when the stock price increases.

Going “short” on the other hand is the opposite of this. Typically when you go “short” on a stock, you want the stock price to fall, because you make money when the stock price decreases.

Disclaimer

The contents on this site are for informational and entertainment purposes only and does not constitute financial, accounting, or legal advice. The author of this blog post assumes no responsibility or liability for any errors or omissions in the content of this site. This information container in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness or timeliness.

So how does one “short” a stock?

Short-Selling

So there are two popular methods that one could “short” a stock.

In a typical stock transaction, you would first buy and then sell. I repeat —

Buy and then sell.

Basically, when you “short” a stock, you would first sell, and then attempt to buy it back —

Sell and then buy.

Wait, what? How do you sell before you even buy a stock?

Well, it turns out whenever you “short” a stock, it basically means that you are borrowing these shares from your broker, typically with a fee.

Example

For instance, when John has $100 in his broker account and he wants to short stock XYZ at $10, he is going to borrow 10 shares from his broker, and then sell them on the market for $10 per share immediately.

John would hope that the XYZ shares he sold for $10 to fall below $10 so that he can then buy them back at a cheaper price to return them to the broker.

In order words, if XYZ shares were to fall to $7, he would have made a profit of $3 per share.

In this example, John has the potential to make a maximum profit of $10 per share, because the most a stock can go down is to $0 per share.

On the other hand, John runs the risk of losing an infinite amount of money, well, simply because there’s no theoretical limit of how high a stock price could go. Stock XYZ could go up to $15…$20…$40…$80…$200…and so on.

If stock XYZ goes up to $15 instead of going down to $10, John now loses $5 per share. Yikes.

You Must Return What You Borrowed

Coming back to the broker, when John borrows the share from his broker, they have a margin requirement.

When stock XYZ gets too high, the broker, which is the borrower is going to want these shares back in order to protect their downside.

Let’s say stock XYZ now goes up to $15 from $10 per share.

“Lucky” for John, the broker is not in the business of coming to him and asking for money, well, rather the broker will forcefully sell John’s share at a loss, which leads to a margin call if John does nothing about it.

John is now in a sticky situation. If John wants to get out, he has to now add more money to his broker account and cover his position.

John now has to buy more shares of XYZ to cover his positions.

As he tries to cover his short position, this creates additional buying pressure to stock XYZ, which in turn drives the stock price of XYZ even higher.

Understanding Outstanding and Floating Shares

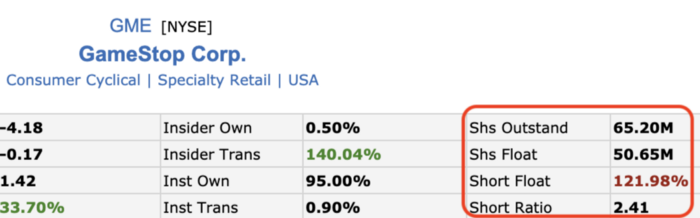

This is a crucial part of what led to a short squeeze that happened to $GME.

Shares outstanding — total number of shares of the company

Shares float — shares that are out in the market for trading

Short float — out of the total number of floating shares, how much of a short percentage do we currently have.

121.98% Short Floats?!

Wait a minute, how can you possibly short more shares than what exists on the market?

It is as if you only have 100 apples in the entire world but you are allowed to sell 121.98 apples?

Turns out when brokers are lending out shares (even shares they don’t have in their “inventory”), they charge a borrowing fee on shares they lent out.

Brokers make money when they are lending out shares.

When you can lend out shares that you don’t have in the inventory, that can potentially cause the short float to go above 100% which is exactly what happened here — naked shorting.

TL;DR of What Happened To GameStop Stock

Now imagine John was “shorting” GME stock on a massive scale instead, along with many other people or institutions who are in his same positions.

When their trades went down south (GME stock goes up), they would have to keep buying shares back to cover their position, in other words, keep borrowing shares at a more and more expensive fee from their brokers.

As investors or traders on the other side of the trade keep buying shares, hence driving the share price further up, John and the rest of the short-sellers are forced to buy GME at an even higher price to cover their short positions.

As this goes on and on, this eventually forms a self-repeating pattern in which the short-sellers are getting squeezed — and hence the term “short squeeze”.

If Day Trading is something you would like to try, please practice in a simulator before putting real money on the line. Please learn a trusted profitable strategy. You can learn how to trade here: