TradingView Paper Trading – Complete User Guide

Some of the best financial advice I can give you is, if you’re new to trading and haven’t yet used a paper trading simulator, now is the time. I recommend you use paper trading software of some kind when you guys are starting out.

Is Paper Trading Worth it?

Some people will avoid using a paper trading simulator when they first start out since they don’t feel it represents the real markets.

They’re right to an extent. You’re not risking real money, so you’re not going to experience the emotions that come along with it trading in a simulator.

Even so, I still enjoy trading simulators. Consider this: before pilots can, they spend hours training in a simulator on the ground. So traders use paper trading the same way pilots use flight simulators. Makes sense right?

What Is Paper Trading?

Paper trading provides simulated trading to the consumer. It’s an environment where people can practice buying and selling securities.

This gives new traders the opportunity to enter orders without risking real money. You can even use historical replays. Paper trading is a good way to practice trading in a risk-free atmosphere where the system tracks your success.

This is usually recommended for beginner traders to first practice simulated trading and get their feet wet. It’s also great for experienced traders testing new strategies.

Why Should I Paper Trade?

There are two key reasons I want to teach you guys how to utilize TradingView paper trading as a stock market simulator.

1) You want to test your trading strategy. A solid trading strategy has three elements to it:

- What to trade.

- When to enter.

- When to exit, at either a profit or a loss.

The major components of any solid trading approach are the same, no matter what strategy you’re trading. It might be a technique like PowerX or The Wheel, either way, it makes no difference.

You want to make sure that the strategy actually works. This is why you want to test it to make sure that you understand the rules so that you’re not making any mistakes, risking real money.

If you are making mistakes, it’s better to find out when you’re not risking real money.

2) The second reason why you should use a simulator first? To gain confidence.

Always Test Your Trading Strategy

Whenever you have a new strategy, you might be wondering if it actually works right?

This is why when you use a simulator to test your strategy and you see that it works, you get more confidence because now you get some actual numbers. I recommend you take at least 40 trades, this way, you have enough details and information to know if the strategy is working.

So you will have a better understanding of how much profit you can make by knowing your winning percentage, your average profit, your average loss, and other important numbers.

Setting Up Paper Trading In 3 Simple Steps

TradingView is a free tool that you can use as a simulator, and you may already be familiar with it already. I use it a lot for figuring out potential trades.

You can customize a multitude of chart settings if the default view doesn’t work for you, notate on a chart at the desired price, making it easier to track and monitor potential trades.

If you would like to learn more about TradingView, click HERE. Signing up is easy. You can use their free version to do this, but if you choose for one of their paid plans, and want to switch back to the free, you can cancel anytime.

So here is a step-by-step walk-through on adjusting your account settings for how you can use TradingView as a simulator.

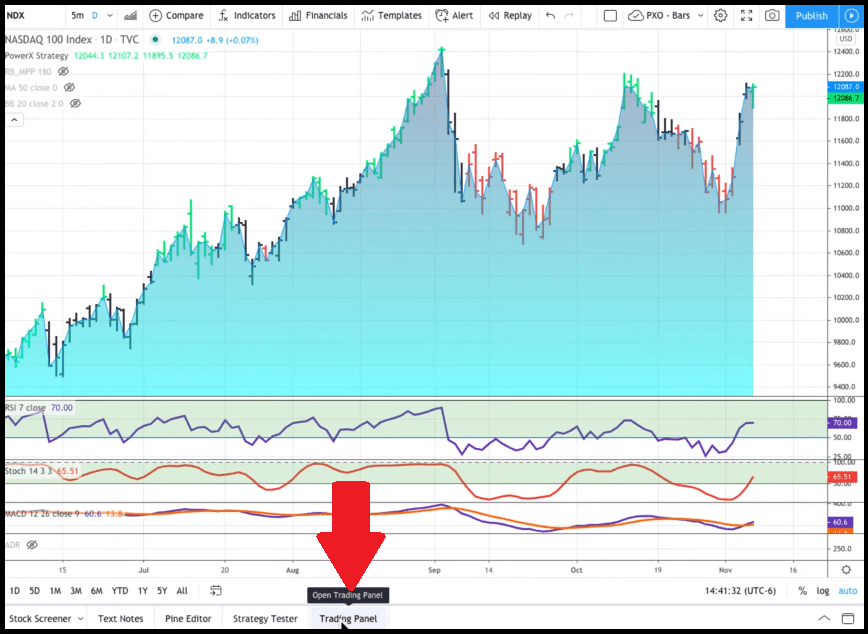

1) Step one. After you sign in on TradingView’s website, you need to connect paper trading, and in order to do this, you go to the trading panel here at the bottom.

Once you bring it up, you can choose your broker and log into your brokerage account. As you can see, it’s usually mainly forex brokers, but you see on the very left side, you see “Paper Trading.”

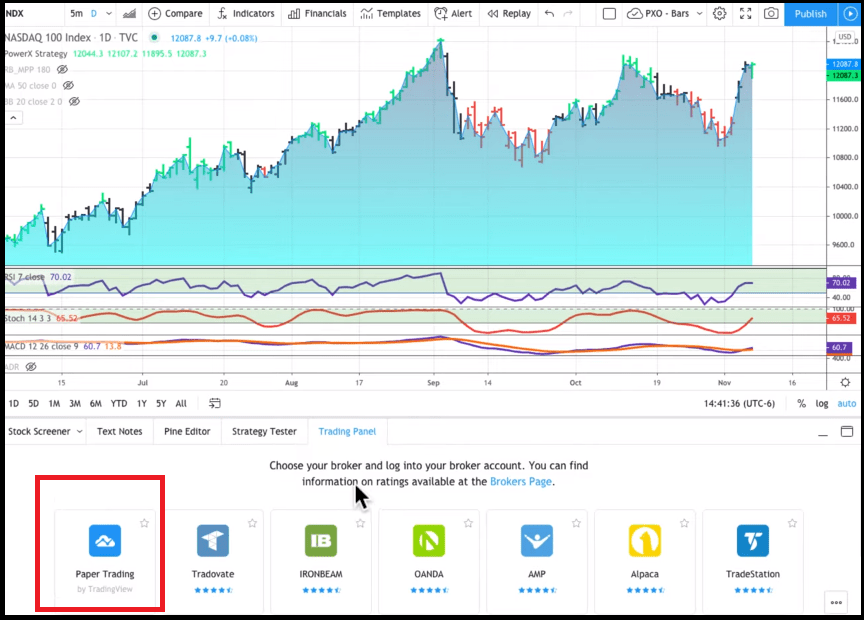

2) Step two. You want to reset your account.

You might be wondering, “Why should I reset my account? I haven’t done anything yet.”

This is because the default values for your account balance start you off with $100,000 by default. This may be a fun fantasy, but maybe not exactly your trading account size

It is very important that you mirror the account balance of your paper trading account, and the account balance starts with the same amount as your real trading account.

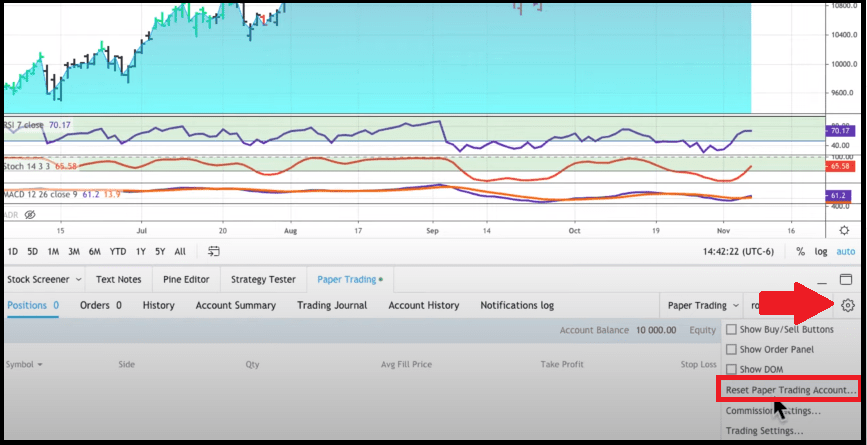

So, therefore, you click on the gear icon there on the right-hand side, and then in the dropdown menu, you see “Reset Paper Trading Account.”

Once you click that, it will prompt you to input your desired starting balance. So if you are planning to start with $10,000 in your real trading account, start with $10,000 when you start paper trading. If you are starting out with an account of $20,000, enter that instead. You get the idea. Then just hit “Reset.”

3) Step three. You will have to adjust a few default settings and before I walk you through how to enter orders.

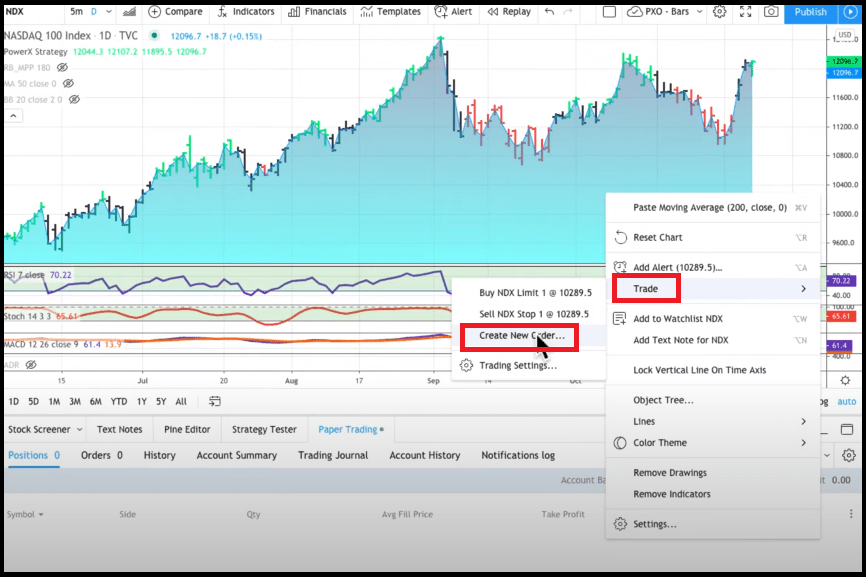

Right-clicking anywhere on the screen in your charts. In the menu, you will see the fourth item down is “Trade”. Go ahead and click on “Trade” then click on “Create New Order.”

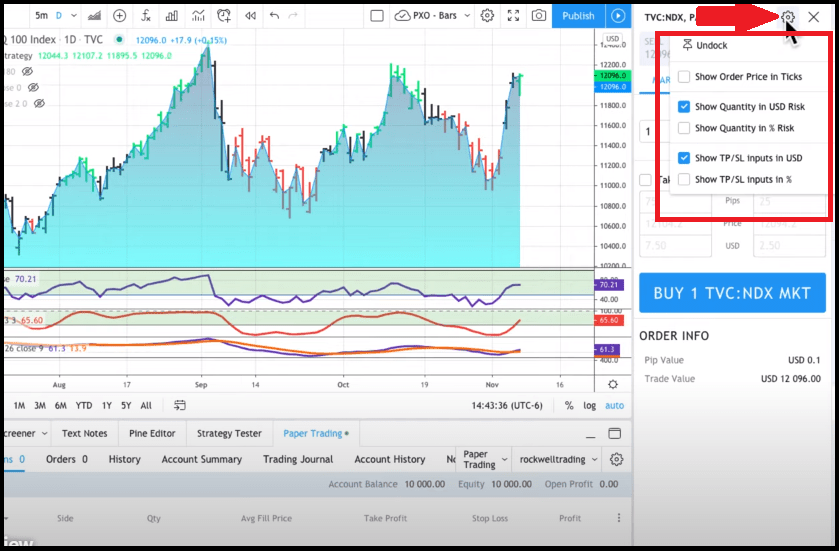

When you click on: Create New Order,” you have an order ticket appearing on the right-hand side of your chart here. You will also see a gear icon. Click the icon to change the settings, and these are the settings that I personally use, so I highly recommend these.

- Uncheck “Show Order Price In Ticks.”

- Check “Show Quantity In US Dollar Risk”

- Uncheck “Show Quantity In Percent Risk.”

- Check “Show TP/SL Inputs In USD,” (that’s Target Profit & Stop Loss).

- Uncheck “Show TP/SL Inputs In %.”

OK, so these are the basic settings in order to use the simulator. Now let me show you exactly how to use it. Now you are ready to place orders

How Do I Use Tradingview’s Paper Trading System?

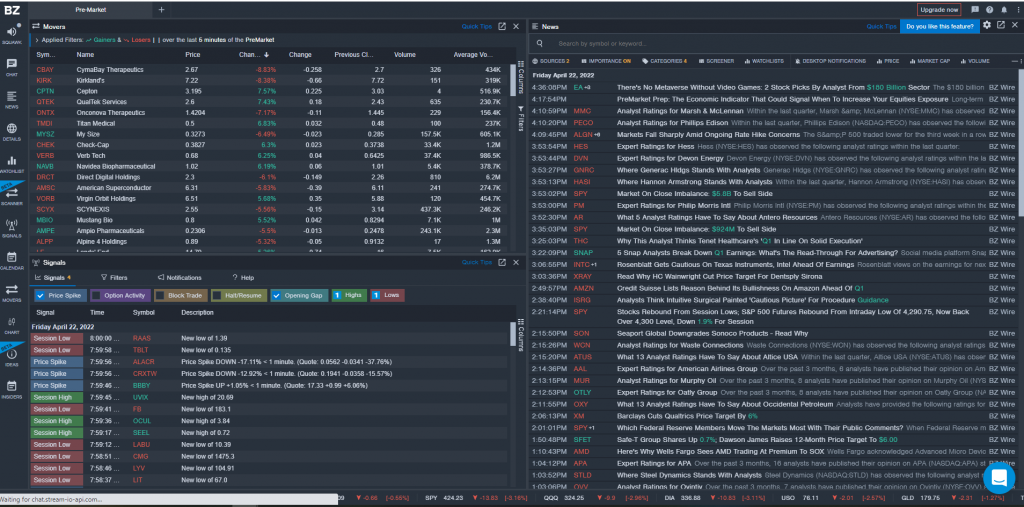

Benzinga Pro is a tool that I personally use to scan for potential trades. You can use it “right out of the box” with its default scanner settings.

When the ticker comes up on the trading tab I quickly go through the list and I’ll look for stocks that have good gaps, good upside/downside trend-ability, and I want to see a nice P&L chart.

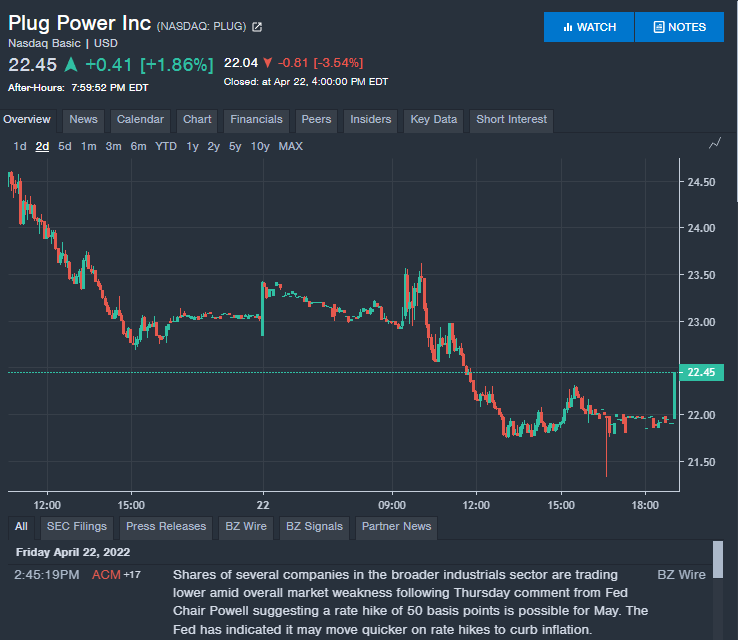

One of the companies the system pulled up was PLUG so let’s use it as an example so that you know how to do this.

Now, remember what I said about how a trading strategy should tell you three things. It should tell you what to trade, when to enter, and when to exit.

Now here is how to use TradingView’s paper trading simulator . So on the right-hand side of the trading tab labeled “Data Window,” we see exactly how many stocks we are trading when we want to enter, and when we want to exit.

Now let’s pull up PLUG in TradingView. So as you can see, now we have to fill in the quantity and where exactly we want to enter.

As you can see, based on a $10,000 account, we would risk $199, almost $200 trying to make $425. So our risk-reward ratio, as you can see here is 1:2.13. We can easily know how much profit we will make.

Then all you need to do is click on “Buy Nasdaq” after you’ve entered all this, and remember, this is not being executed as your broker. This is a simulator. So you don’t make it and you don’t lose any money.

This is for testing your trading strategy and gaining confidence. So let’s just say buy and you see the order is sent right now.

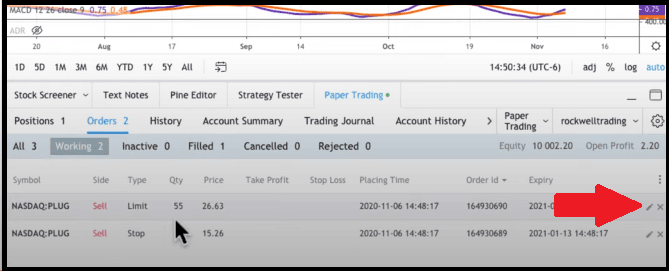

Once the order is placed you will now have one position and two orders in the market. Those orders are a sell limit order for our profit target, and a sell stop order for our stop loss.

So as you can see, it is super easy to use this simulator here.

View Order

After you enter orders, you can now change the open positions that you do have in the market here, so you can change them to a different price by clicking the little edit sign right there on the right.

So you see exactly what open positions you have right now, what you bought, you have the working orders, you have the filled orders here and now, if you want to cancel an order, if you would change any working orders, for example, if you want to change your stop loss, you just click on the edit here and change it to any value that you want.

By the way, the right way to move your stop loss is always closer to your entry price, never away. Never, ever give a trade more room, it usually ends in disaster.

Summary

This is how this trading simulator works. So why do you need a simulator? To first test your trading strategy to see if you understand the rules, and to see if the trading strategy works. Finding all this out by can practice buying and selling securities boosts your confidence, giving you more courage to actually go out and trade. And that’s exactly what we do here with TradingView. It’s a great system.

Here is a very brief article about how paper trading is useful for testing your trading strategy without risking any money. It’s easy will gain your confidence, all with no risk.

You can set up your TradingView account for paper trading in three easy steps:

1) You connect the paper trading account.

2) You reset it to the account size that you are planning to trade.

3) You modify the order settings.

Very simple. Then you just pick any stock that you want. The best thing is, it’s free. I highly recommend that you do this.

If you found this article on Using Trading View For Charting And Paper Trading. helpful and know somebody who can benefit from this, please feel free to share it. You literally have nothing to lose.

If Day Trading is something you would like to try, please practice in a simulator before putting real money on the line. Please learn a trusted profitable strategy. You can learn how to trade here: